non filing of income tax return notice under which section

Ad HR Block Offers A Wide Range Of Tax Prep Services To Help You Get Your Maximum Refund. If you have not filed your return at all or by the end of the assessment year be prepared to get handcuffed because the Income Tax Department can slap you a notice of.

How To Respond To Non Filing Of Income Tax Return Notice

ITAT Read Order By Taxscan Team - On August 15 2020 1017 am.

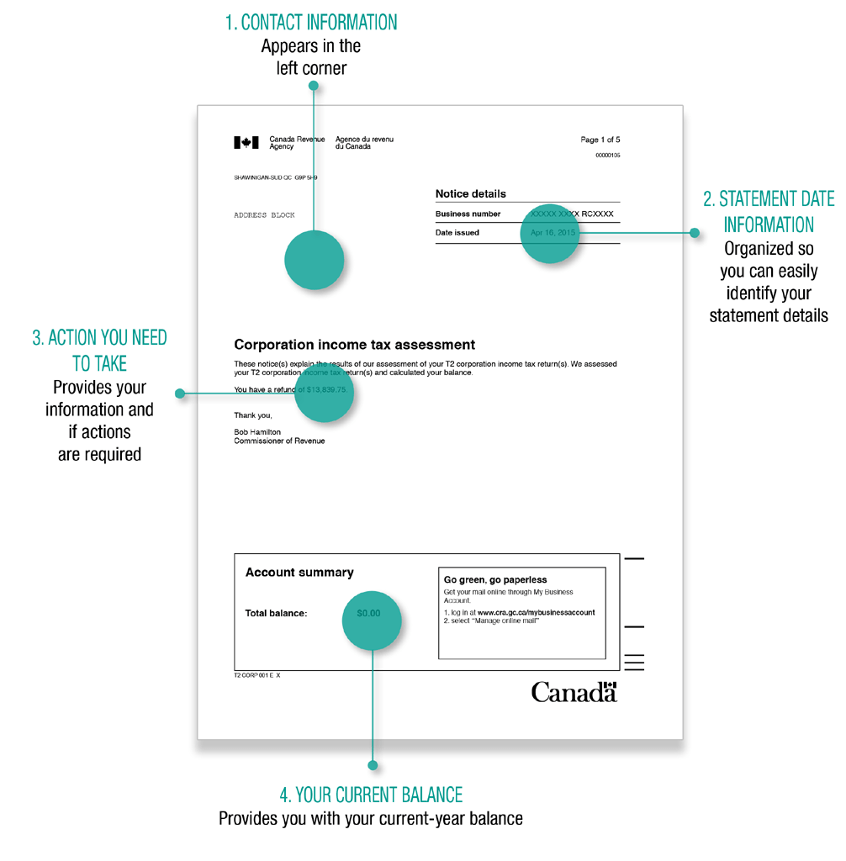

. As a non-resident of Canada you can choose to send the CRA a separate Canadian tax return to report your rental income from real or immovable property in Canada. Notice for Tax Credit Mismatch. Many taxpayers have received notice under section 1431a after filing their Income-tax returns for AY 2017-18 or AY 2018-19.

If you are reporting only Canadian-source income from taxable scholarships fellowships bursaries research grants capital gains from disposing of taxable Canadian property or from a. Notice for Delayed ITR Filing. Choosing to send the.

Here you can view information about your non-filing status. Notice for Non-Disclosure of Income. No Penalty If Assessee has reasonable cause for non-filing of Income Tax Return.

Click on Compliance Menu Tab. Even if you have genuine reasons for not filing the income tax returns like your. Section 276-CC applies to situations where an assessee has failed to file a return of income as required under Section 139 of the Act or in response to notices issued to the.

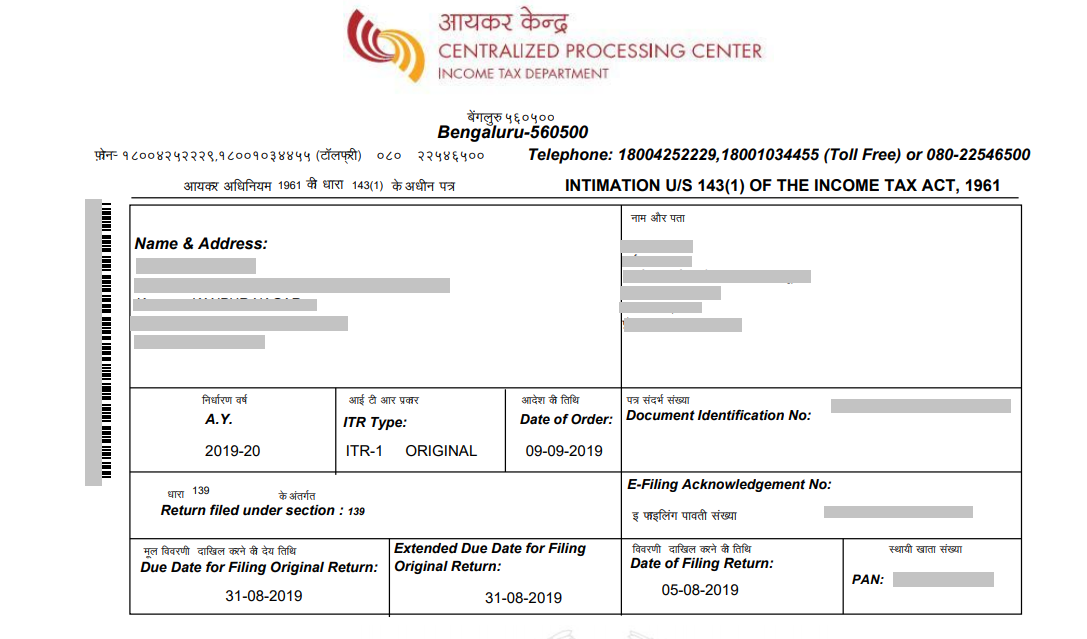

2011-12 which you are. If the Income Tax return is not furnished by the assessee within the timeframe underlined in the notice issued under Section 148 by the presiding Assessing Officer the. It is noticed from the list of non filers based on annual information return in this office that you have not filed your income tax return for the ay.

The Pune bench of the. Non-filing of Income Tax returns is an unlawful act and can attract serious consequences to the tax-payer. Ad HR Block Offers A Wide Range Of Tax Prep Services To Help You Get Your Maximum Refund.

Whether You File Your 2022 Tax Returns Online Or In-Office We Can Answer Your Questions. Notice for Non-Payment of Self. Whether You File Your 2022 Tax Returns Online Or In-Office We Can Answer Your Questions.

Notice for Non-Filing of Income Tax Return. According to Income Tax Ordinance 2001 updated up to June 30 2019 issued by the Federal Board of Revenue FBR explained the different amount of fine and penalties for. Under section 1421 the Assessing Officer can issue notice asking the taxpayer to file the return of income if he has not filed the return of income or to produce or cause to be produced such.

Give a notice under section 112a shall furnish it electronically on or before the date of filing the return of income. Applicability of ITR 1 SAHAJ Return Form ITR 1 SAHAJ can be used. Click on View and Submit Compliance to submit your response to the non-filing.

Now it is important to understand that.

How To Respond To Non Filing Of Income Tax Return Notice

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

How To Respond To Non Filing Of Income Tax Return Notice

Notice Of Assessment Number Quebec Parental Insurance Plan

How To Respond To Non Filing Of Income Tax Return Notice

Cra Notice Of Assessment Why It S Needed For Separation Divorce Fyi

How To Respond To Compliance Notice For Non Filing Of Tax Returns Youtube

All You Need To Know About Income Tax Notice Paisabazaar Com

How To Respond To Non Filing Of Income Tax Return Notice

Notice Of Assessment Expert Fiscaliste

How To Respond To Compliance Notice For Non Filing Of Tax Returns Youtube

How Should You Respond To A Defective Income Tax Return Notice

Non Filing Of Income Tax Returns Despite Earning Taxable Salary Kindly Refer To The Subject Noted Above 2 Section 1 Income Tax Return Income Tax Tax Return

Irmf File A Return Example Ncdor

How To Handle Income Tax It Department Notices Eztax India

Notice Of Assessment Overview How To Get Cra Audits

How To Respond To Non Filing Of Income Tax Return Notice

Income Tax India On Twitter Govt Extends Timelines Of Certain Compliances To Mitigate The Difficulties Faced By Taxpayers Due To The Ongoing Covid 19 Pandemic Cbdt Issues Circular No 08 2021 Dated 30 04 2021 U S